Two separate authorized difficulties to Biden’s Help you save system have worked their way from the courts. In June, federal judges in Kansas and Missouri issued separate rulings that blocked Significantly of the administration’s prepare to provide a speedier path toward loan cancellation and minimize month to month income-dependent repayment from 10% to 5% of the borrower’s discretionary income. All those injunctions did not impact debt that experienced by now been forgiven.

Jordan Tarver has invested seven several years masking mortgage, personal loan and business enterprise loan content material for foremost financial publications such as Forbes Advisor. He blends know-how from his bachelor's degree in company finance, his experience as a major performer inside the mortgage marketplace and his entrepreneurial success to simplify intricate money subject areas. Jordan aims to generate mortgages and loans easy to understand.

Such as, you may not be accepted simply because you don’t fulfill the lender’s “power to pay out conventional” when they verify your earnings and employment; or, you already have the utmost amount of accounts with that specific lender.

A regular monthly payment calculator helps you to Evaluate unique eventualities and how they might have an effect on your spending plan. Referring towards the earlier case in point, perhaps $300 every month is simply too costly for you personally.

HELOC A HELOC is usually a variable-rate line of credit that permits you to borrow funds for just a set interval and repay them later.

Generally, individuals with bigger credit scores qualify for reduce rates than those with reduce credit scores. But different lenders have various criteria for approving borrowers, so it makes sense to buy all-around.

These organizations typically have cellular apps, and they’ll progress you as many as $500 a pay interval when you satisfy skills.

NAV loans, that happen to be collateralised by the person investments inside of a fund and can equal approximately 20 for each cent on the fund’s In general benefit, have enabled firms to extract money from their portfolios without needing to market property in tricky marketplaces.

By clicking “Settle for All Cookies”, you agree to the storing of cookies with your product to improve website navigation, examine web page usage, and aid within our marketing attempts.

Tips on how to enroll in this strategy: You’re instantly Article source positioned from the conventional approach when you enter repayment.

The presents that appear on This website are from third party advertisers from which Credit Karma gets payment. This compensation could impression how and where items look on This page (including, as an example, the buy where they seem).

Personal equity companies slash utilization of risky debt tactic to fund payouts on facebook (opens in a fresh window)

Superior credit necessary — Without having a powerful credit profile, maybe you have problems qualifying for the loan with LightStream.

When you don’t choose to (or can’t) use home equity to fund improvements, LightStream may very well be a fantastic possibility. The lender features very aggressive interest rates and claims to conquer other lenders’ rates in sure instances.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Anna Chlumsky Then & Now!

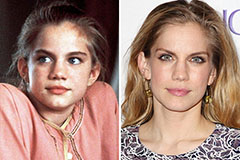

Anna Chlumsky Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now!